Almost all of us have got PAN cards. Some of us have not mapped or linked aadhar to their pan cards.

After Demonetization , Department of income tax have decided that every pan card holder must link their Aadhar card to PAN card.

30 of june 2020 is the dead line to link aadhar to pan card

Read the follow

1. Quoting of Aadhaar in the return of income

Section 139AA was inserted into the Income Tax Act vide Finance Act 2017 wherein it imposed the following mandates :

a. Every person who is “eligible to obtain an Aadhaar”, must quote the Aadhaar number in the PAN application form as well as the return of income with effect from 1 July 2017.

b. Those who did not possess the Aadhaar number could quote their Aadhar enrollment ID in the return of income.

c. Every person who had been allotted PAN as on 1 July 2017, and has received the Aadhaar number, must intimate the number to the tax authorities by linking PAN and Aadhaar.

d. Failure to intimate Aadhaar number would lead to the PAN being inoperative.

2. Supreme court ruling on Aadhaar PAN linking

The constitutional validity of the section 139AA was mentioned before the Hon’ble Supreme Court (SC). The SC, in its judgement, upheld the legal validity of this section in its entirety and provided partial relief. The relief was in respect to Point (d), where the SC declared that the non-obtaining of an Aadhaar number would not lead to PAN becoming inoperative.The income tax department has notified the manner in which the PAN will become inoperative if not linked to aadhaar within the specified due date. If the PAN becomes inoperative, it will be deemed that the PAN was not furnished or intimated wherever required and all the consequences of non-furnishing of PAN will be applicable to the individual.The same will be operative only after the date of linking with aadhaar PAN. (notification no 11/2020)

Accordingly, all other provisions of section 139AA in respect to quoting Aadhaar or Aadhaar enrolment number in the return of income or linking of Aadhaar with PAN etc. would continue to hold good.

Ref : Press Release dated 10 June 2017 (pursuant to the SC decision)

Here is procedure to link aadhar to pan card

Visit the link given

CLICK HERE TO VISIT WEBSITE

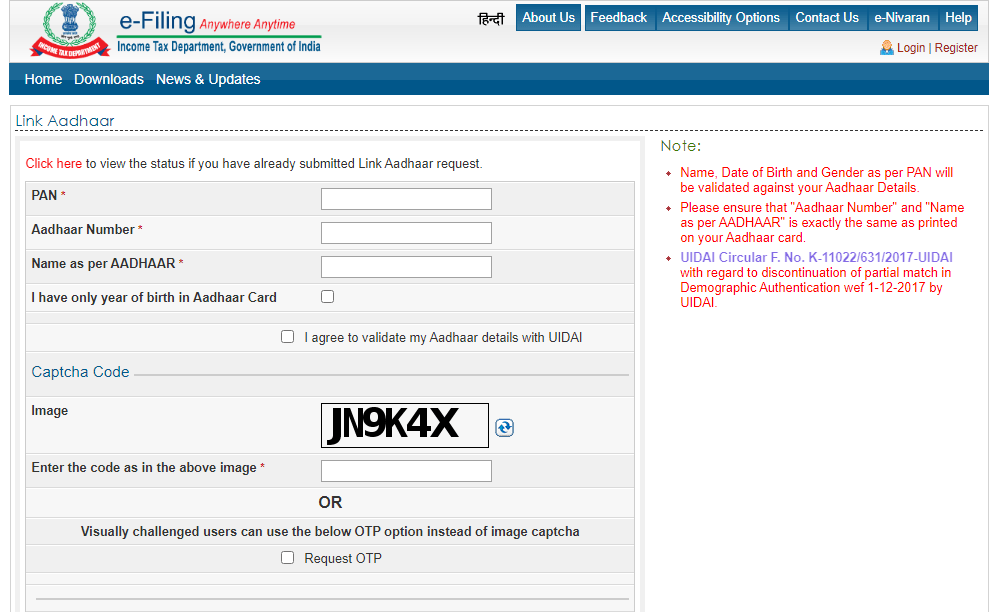

The interface of the website will as

Enter your details that are to be entered.

Make sure that check the boxes to go further.

then click on link aadhar

then an OTP request will sent to you then accept it and click continue

Then you will receive an OTP to your registered mobile number

enter the otp and click on validate .

That’s it

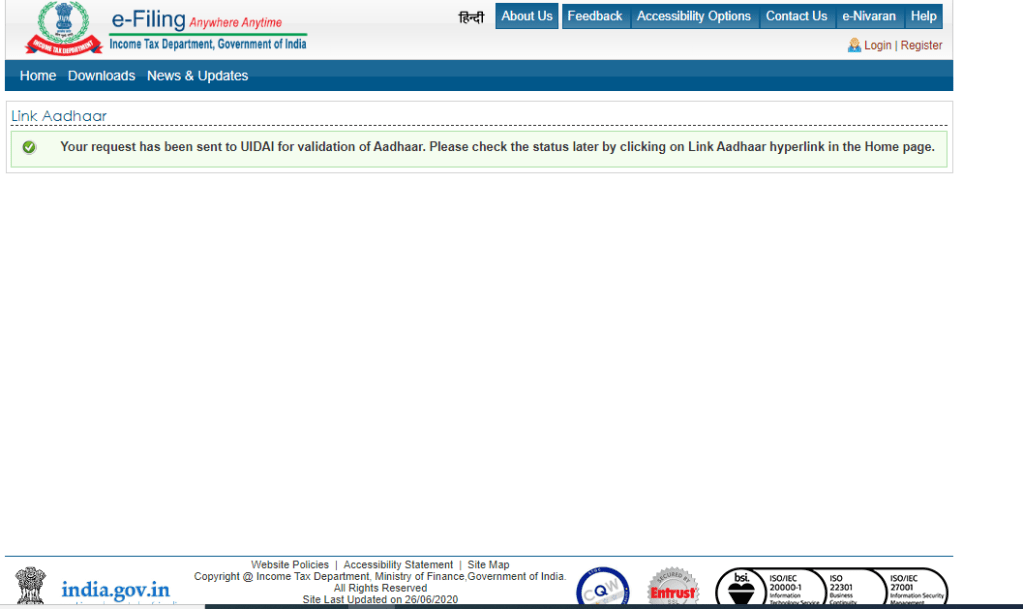

This page will be shown and say that our request sent successfully.

that’s the procedure.

Check link status

https://www1.incometaxindiaefiling.gov.in/e-FilingGS/Services/AadhaarPreloginStatus.html

Follow for more updates

Thank you

G.Prudvi raj